Hassle free and cheap foreign currency transfers with Moneybookers

One internet service that I've not written about before, but use several times a year for our French home is Moneybookers for transferring money to my French bank account.

Our French bank account is with La Poste (the French Post Office) and although we don't need lots of money in the account we do need to pay for direct debits and cheques such as electricity and water bills, council tax (taxe de habitation/taxe fonciers), pay our agents that look after the house, etc.

So periodically we need to transfer money over to France from our UK bank account.

If you go into a UK bank and ask them about transferring money over then you'll often get quoted a poor exchange rate and have to pay a £15 or £20 bank transfer fee. Given that we knew we'd need to transfer money over on a semi-regular basis we were keen to find a more cost effective manner and after a bit of searching came across Moneybookers which we've been using successfully for over 3 years now.

Here's how it works:

Moneybookers acts as an electronic bank which you can transfer money into and withdraw money out of. The clever bit is that it has interconnections to banks in 30 or so different countries so you can transfer money directly in and out of bank accounts in any of these countries for free. The list of countries directly supported is quite extensive and includes most of Europe including the UK, France, Spain, Germany, Switzerland, Portugal as well as USA, China, Brazil, India, Singapore, Australia, etc.

The fees vary slightly depending on the countries concerned but are almost all free to deposit money and either £1.30 or £2.40 to withdraw funds depending on whether you want the money transferring direct into a bank account or paid out by cheque. In addition any foreign currency exchange is converted at the European central bank daily interbank rate plus 0.95% - a considerably better rate than you would get from a high street bank.

Transferring money to my French bank account using moneybookers is a straight forward four step process:

1. From my UK bank account I firstly transfer the required funds into my moneybookers account as a manual standing order payment

2. When the money arrives in moneybookers I receive an email telling me my account has been credited (this is usually 3 or 4 days after I sent it)

3. I then login to moneybookers and request a withdrawal of my moneybookers account balance into my French bank account

4. About 4 or 5 days later the moneybookers withdrawal arrives in my French bank account

Setting up the service is pretty straight forward, here's a summary of the process:

Once you've registered your moneybookers account you need to create a standing order from the source bank account (which in my case is the UK but can be any of the 30 or so countries moneybookers operates in).

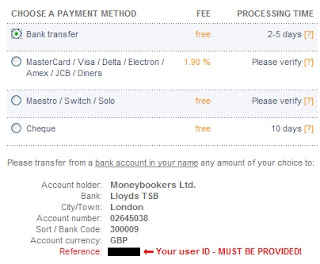

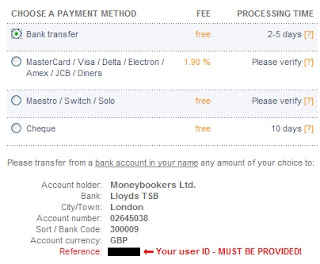

Click 'Upload' and you'll be presented with four different ways of crediting your moneybookers account - I use Bank Transfer (which is free) or you can use Maestro/Switch which is also free, or credit/debit card (1.9% fee):

Use these details to setup a standing order from your UK bank account - which must be in your name (for compliance with anti-money laundering regulations).

Next you need to setup the corresponding withdrawal facility within moneybookers to your French bank account (or wherever else in the world you want):

Click 'My Account', then 'profile' then 'Manage' (next to 'List of bank accounts'), and 'Add'.

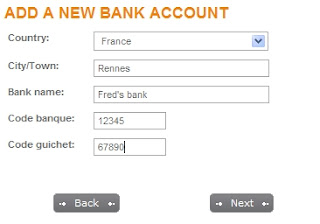

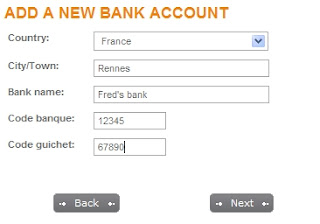

On the next screen choose the country your destination bank account is in (so France in my case) and enter the bank's details:

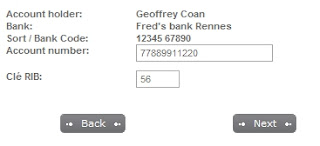

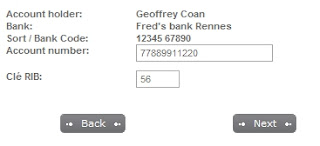

Click 'Next', then enter your account details:

And that's it!

In the 3 years or so I've been using moneybookers I've had no problems at all, the only thing to be aware of is that by having to transfer your money via moneybookers as an intermediary it can take up to 2 weeks from start to finish to clear into your French account, but considering the savings over other transfer mechanisms I consider this an acceptable compromise - you just have to be organised enough to transfer funds before you need them!

Categories:

Our French bank account is with La Poste (the French Post Office) and although we don't need lots of money in the account we do need to pay for direct debits and cheques such as electricity and water bills, council tax (taxe de habitation/taxe fonciers), pay our agents that look after the house, etc.

So periodically we need to transfer money over to France from our UK bank account.

If you go into a UK bank and ask them about transferring money over then you'll often get quoted a poor exchange rate and have to pay a £15 or £20 bank transfer fee. Given that we knew we'd need to transfer money over on a semi-regular basis we were keen to find a more cost effective manner and after a bit of searching came across Moneybookers which we've been using successfully for over 3 years now.

Here's how it works:

Moneybookers acts as an electronic bank which you can transfer money into and withdraw money out of. The clever bit is that it has interconnections to banks in 30 or so different countries so you can transfer money directly in and out of bank accounts in any of these countries for free. The list of countries directly supported is quite extensive and includes most of Europe including the UK, France, Spain, Germany, Switzerland, Portugal as well as USA, China, Brazil, India, Singapore, Australia, etc.

The fees vary slightly depending on the countries concerned but are almost all free to deposit money and either £1.30 or £2.40 to withdraw funds depending on whether you want the money transferring direct into a bank account or paid out by cheque. In addition any foreign currency exchange is converted at the European central bank daily interbank rate plus 0.95% - a considerably better rate than you would get from a high street bank.

Transferring money to my French bank account using moneybookers is a straight forward four step process:

1. From my UK bank account I firstly transfer the required funds into my moneybookers account as a manual standing order payment

2. When the money arrives in moneybookers I receive an email telling me my account has been credited (this is usually 3 or 4 days after I sent it)

3. I then login to moneybookers and request a withdrawal of my moneybookers account balance into my French bank account

4. About 4 or 5 days later the moneybookers withdrawal arrives in my French bank account

Setting up the service is pretty straight forward, here's a summary of the process:

Once you've registered your moneybookers account you need to create a standing order from the source bank account (which in my case is the UK but can be any of the 30 or so countries moneybookers operates in).

Click 'Upload' and you'll be presented with four different ways of crediting your moneybookers account - I use Bank Transfer (which is free) or you can use Maestro/Switch which is also free, or credit/debit card (1.9% fee):

Use these details to setup a standing order from your UK bank account - which must be in your name (for compliance with anti-money laundering regulations).

Next you need to setup the corresponding withdrawal facility within moneybookers to your French bank account (or wherever else in the world you want):

Click 'My Account', then 'profile' then 'Manage' (next to 'List of bank accounts'), and 'Add'.

On the next screen choose the country your destination bank account is in (so France in my case) and enter the bank's details:

Click 'Next', then enter your account details:

And that's it!

In the 3 years or so I've been using moneybookers I've had no problems at all, the only thing to be aware of is that by having to transfer your money via moneybookers as an intermediary it can take up to 2 weeks from start to finish to clear into your French account, but considering the savings over other transfer mechanisms I consider this an acceptable compromise - you just have to be organised enough to transfer funds before you need them!

Categories:

1 Comments:

Nice blog for transfer money online. it's facilitate commercial foreign exchange fast money transfer to france services to overseas.

By Devid, at May 20, 2010

Devid, at May 20, 2010

Post a Comment

<< Home