Musical introduction

Paraphrasing the lyrics from "Money's Too Tight To Mention" from the great Mick Hucknall of Simply Red (who my wife Liz has a real crush on -- I think its the red hair), "We're talking about money, money", or to be more accurate, "We're talking about money transfers, money transfers", but since this doesn't have quite the same rhythmic structure to it, I doubt that anyone has written a song about transferring money from one country to another.

Moneybookers the story so far

I wrote in 2007 about

the benefits of Moneybookers for easy (and cheap) foreign currency transfers, giving step by step instructions as to how to use their service and I've used them now for many years to transfer money from the UK to my French bank account, and I've stayed with them when

Moneybookers increased their transaction fees in 2008 as they were still cheaper than the high street banking alternatives.

But I think its now time to change allegiance.

The internet world moves on and Moneybookers rebranded themselves a couple of years ago as

Skrill, but the domain name and the service all remained the same so all was good.

However in February 2012 Skrill/Moneybookers wrote to me to advise of changes to their terms and conditions. Most significant of which is that they've introduced an 'inactivity fee' of €1 per month if you haven't logged in or made a transaction using your Skrill account within the previous 18 months. This inactivity period was then reduced from 18 to 12 months in December 2012 so I can see the trend happening here ...

OK, so I have to regularly login to my Skrill account to avoid the inactivity service fee, but is it still good value for money?

Last month I needed to transfer £1000 to my French bank account so I thought I'd review whether I was still making the best choice for my foreign currency transfer.

First up, I bank with Nationwide Building society, so I thought I'd see what

Nationwide would charge for an overseas Swift transfer, but the website didn't actually tell me, and I had to phone up to find out what the interest rate applied would be!

Nationwide would charge £25 for the transfer and offered me a transfer rate of 1.191, meaning I'd get €1161.23 paid into my French bank account from my £1000.

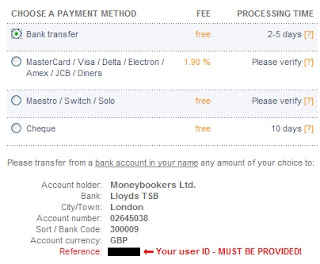

Next I looked at Moneybookers/Skrill,

Skrill offer the wholesale exchange rate minus 2.49% and then charge £1.48 on top to withdraw funds into a Euro account.

I had to do a bit of math to convert the Skrill exchange rate from Pounds per Euro into the reverse Euros per Pound, take off the 2.49% exchange rate loading, and the withdrawal fee and I worked out I'd get €1192.14 for the same £1000 - i.e. €31 more.

Better, but can I improve on this exchange rate?

The new big thing in the world of money transfers is peer to peer

The principles of peer to peer money transfers are dead simple, instead of using a bank to transfer your money from one currency to another, you find someone who wants to transfer money in the reverse direction (from Euros to Pounds in my case), and just like you might do in and old fashioned marketplace you swap the money between yourselves. In truth this is no different to how the financial institutions emerged from the Coffee houses of 200 years ago, but now accomplished using the internet to bring buyers and sellers together to swap money between themselves.

There's an article explaining

how peer to peer money transfers work over on the Quidco blog, but since the article is written by TransferWise who offer a peer to peer service, you can also read a less biased report on

5 ways to transfer money abroad on LoveMoney.com.

So trying them out for real, I looked in more depth at

CurrencyFair and

TransferWise, both of which offer a very similar service.

TransferWise is the simplest, you enter how much of what currency you want to convert, the recipient bank account details to transfer the money into, you're given an indicative exchange rate, and if you accept it your conversion is 'booked'.

You then transfer the money from your bank account into your transferwise account, and once your money arrives the transaction is done.

Last year I tried TransferWise for the first time and it worked pretty well. There was a slight hiccup because when the money was transferred from my UK account into my TransferWise account they couldn't associate the deposit with my account because my transferwise account had been created in my name whereas our bank account is in joint names. I guess its due to money laundering regulations that they check that the account names match, but a quick email giving the full names on all the accounts sorted the problem out and the transfer was done.

TransferWise

now accept debit cards for payment so it's now even easier to transfer money in just one step.

For £1000 TransferWise offered me an exchange rate of 1.2146, there was a fee of £4.48 to transfer the money into my French bank account, so in total I'd receive €1209.16 - an increase of €17 on top of Skrill, a welcome improvement.

(NB: Looking today on TransferWise the transfer fee now seems to have increased slightly to £4.98 so the difference will be less)

This time though I thought I'd try the other big peer to peer transfer service, CurrencyFair. CurrencyFair offer a very similar 'QuickTrade' service whereby they do the matching, or they offer a 'Marketplace' service where you can actually see what other currency swaps are being offered and either accept one of them or request a different rate, hoping that someone else will decide to take you up on your offer.

CurrencyFair's QuickTrade offered me a rate of 1.2114 with a €3 transaction fee to deposit the money into my French account, so I'd receive €1208.40, but as I said you can try to better that in the Marketplace so I thought I'd give that a go.

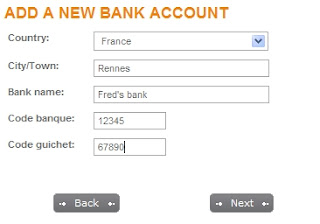

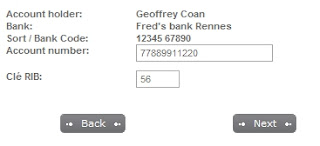

First step in the process was that I found that I had to record the different currency holding accounts in CurrencyFair. I needed to create GBP and EUR accounts and then deposit the required GBP with CurrencyFair before I could try to do a transfer, but it didn't take too long to do this, setup the transfer details from my bank, and thanks to same day transfers the money arrived at CurrencyFair within about an hour.

With the MarketPlace you can nominate what rate you want to convert the money at, so I thought I'd ask for 1.2160 which was slightly better than the QuickTrade rate and would have netted me €1213 if it had matched successfully.

15 minutes later my trade was matched, but unfortunately not for the full amount, I was only partially matched but at least my first £204.97 was now converted to €249.25.

Result!

Unfortunately I then watched for the rest of the day as the market dropped and the rates offered on CurrencyFair slid slowly downwards, until at 8pm when the market closed and my conversion request was cancelled.

Next day I tried again, requesting the same conversion rate of 1.2160, but by then this wasn't a competitive rate and my trade sat there all day unmatched until 5pm in the afternoon when I cancelled the request and booked the best rate on offer at that time, 1.2000, converting my remaining £795.03 into €954.03.

So over the two trades and after paying the €3 transfer fee I managed to receive €1200.28 into my French bank account which duly arrived a day or so after initiating the transfer out from CurrencyFair.

So in summary ...

Firstly its clear that TransferWise and CurrencyFair offer a better transfer rate than my previous favourite Skrill/Moneybookers, although in my case it wasn't a massive difference - €17 or 1.4% more currency, but its worth remembering that all of these still beat the high street banks hands down.

Secondly you have to look carefully at the fees and exchange rates offered. TransferWise charges you a fee in Pounds (£4.98), CurrencyFair's fee is in Euros and is lower (€3), but when I was doing my transfer CurrencyFair's exchange rate wasn't quite so good, so this eliminated the fee difference.

Thirdly, by using the CurrencyFairs's Marketplace that shows you real time exchange rates offered by other customers you can get an even better rate, or if the market is sliding away from you, you won't, and locking in to a guaranteed rate earlier in the day could have been a better option.

With both companies your money should be safe, CurrencyFair is regulated by the Central Bank of Ireland and TransferWise by our own FSA.

In conclusion I suspect I'll continue using CurrencyFair and TransferWise for my foreign currency transfers, and will close my Skrill account if I'm not going to use it.

PS: Here's the

full lyrics to Simply Red's "Money's too tight to mention"Labels: Banking, France